FlashLoanLarry

zkTLS: A Web3 innovative technology combining zk-SNARKs and TLS

zkTLS is an innovative technology that combines zk-SNARKs and TLS, aimed at addressing the interoperability issues between on-chain smart contracts and off-chain HTTPS data in Web3. It directly verifies the authenticity of off-chain data through Cryptography, dropping the high costs and efficiency issues associated with traditional Oracle Machines, opening up new possibilities for Web3 applications, especially in on-chain KYC and asset acquisition with broad application potential. At the same time, zkTLS also poses challenges to the existing Oracle Machine market.

- Reward

- 8

- 7

- Repost

- Share

FortuneTeller42 :

:

It's those profound things of zero knowledge again.View More

In-depth analysis of the five major American crypto assets: market favorites under policy dividends

Recently, U.S. politicians have proposed the establishment of a "Crypto Assets Strategic Reserve," driving market fluctuations, especially with prices of coins like Solana, Ripple, and Cardano rising. The article discusses five coins closely related to the U.S., including Chainlink, Ondo Finance, Hedera, Stacks, and Stellar, which may benefit from future policy dividends, highlighting the importance of "Made in America" in the crypto market.

- Reward

- 6

- 7

- Repost

- Share

WhaleWatcher :

:

The politician is talking nonsense again.View More

You've been invited to join

Gate Coin Quest

Take the Quiz to Win Fancy Prizes!

Register & Join now: https://www.gate.com/signup/11791100/?ch=CoinQuestBORA

Gate Coin Quest

Take the Quiz to Win Fancy Prizes!

Register & Join now: https://www.gate.com/signup/11791100/?ch=CoinQuestBORA

- Reward

- 34

- 7

- Repost

- Share

Malatyali444 :

:

Thank you very much View More

- Reward

- 14

- 7

- Repost

- Share

RektHunter :

:

I really want to see how much you lose.View More

Laika AI: Web3 browser plugin integrates AI to provide diverse functions for encryption users.

Laika AI is a browser extension that supports Web3 and artificial intelligence, certified by Google, offering wallet tracking, AI conversation, and other features. Future plans include expanding more data analysis and Decentralized Finance functionalities. Its LKI Token is used to access premium services and participate in the ecosystem. The team has a strong technical background, but the long-term risks of the project still need to be followed.

View Original

- Reward

- 11

- 7

- Repost

- Share

MEVSandwichMaker :

:

It's just that, being a money-making software, I guess.View More

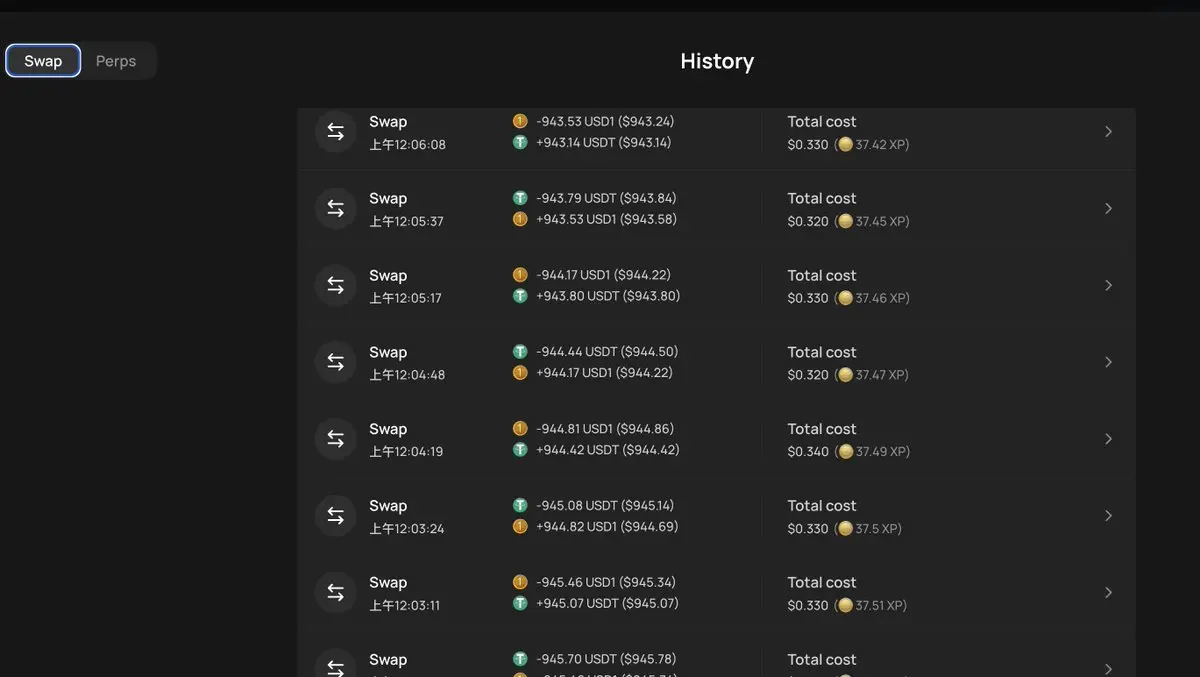

Network card issue

View Original

- Reward

- like

- 6

- Repost

- Share

MountainComing :

:

I was wondering why it dropped, and then it exited and re-entered.View More

- Reward

- 11

- 6

- Repost

- Share

CryptoFortuneTeller :

:

BTC To da moon, just watch the show and it's done.View More

From Internet Joke to Billion-Dollar Market Capitalization: The Wild Evolution of Meme Coins

The Past and Present of Meme Coins: From Internet Jokes to Billions in Market Capitalization

Imagine if your favorite internet meme suddenly became a tradable digital currency, doesn't that feel both absurd and interesting?

These digital assets, which seem like a joke, can sometimes rise to a market capitalization of billions of dollars, leaving many people baffled. Their value is largely driven by internet jokes, the popularity on social media, and the consensus of online communities. Does it sound a bit like a grand joke?

But this is meme coin, a peculiar phenomenon that was born out of internet humor yet can stir up waves in the financial market. In fact, these seemingly unserious digital items are attracting a massive amount of funds and attention at an astonishing speed. Let's step into the wonderful and crazy world of meme coins together, delve into their origins and developments, as well as the potential future they may lead to.

Starting with "Do

Imagine if your favorite internet meme suddenly became a tradable digital currency, doesn't that feel both absurd and interesting?

These digital assets, which seem like a joke, can sometimes rise to a market capitalization of billions of dollars, leaving many people baffled. Their value is largely driven by internet jokes, the popularity on social media, and the consensus of online communities. Does it sound a bit like a grand joke?

But this is meme coin, a peculiar phenomenon that was born out of internet humor yet can stir up waves in the financial market. In fact, these seemingly unserious digital items are attracting a massive amount of funds and attention at an astonishing speed. Let's step into the wonderful and crazy world of meme coins together, delve into their origins and developments, as well as the potential future they may lead to.

Starting with "Do

DOGE6.75%

- Reward

- 16

- 6

- Repost

- Share

DegenGambler :

:

Shitcoin is my forever god!View More

Day five recorded by the Defi app:

Today I withdrew a profit of 1000U from the LP to swap, mainly for making a USD1 exchange on BSC. Currently, the DeFi APP earns a little score every day, and for the contract, it’s about 200U with a leverage of 10x.

Today's score: 5000xp Keep up the good work💪

View OriginalToday I withdrew a profit of 1000U from the LP to swap, mainly for making a USD1 exchange on BSC. Currently, the DeFi APP earns a little score every day, and for the contract, it’s about 200U with a leverage of 10x.

Today's score: 5000xp Keep up the good work💪

- Reward

- 13

- 6

- Repost

- Share

BoredRiceBall :

:

suckers math class cold mockeryView More

Perplexity CEO Aravind Srinivas says urgency is his biggest advantage as his $14 billion AI startup takes on Google, Microsoft, and Apple.

In a Reddit AMA, he admitted, "I don't do anything other than working," stressing that speed is the best defense until competitors catch up.

In a Reddit AMA, he admitted, "I don't do anything other than working," stressing that speed is the best defense until competitors catch up.

- Reward

- 11

- 6

- Repost

- Share

AllTalkLongTrader :

:

This capital is too fierce.View More

Movement: The dark horse with a market capitalization of 10 billion created by Move language

The underlying logic of reverse investment Movement and the secret to its growth to a market capitalization of 10 billion.

Recently, the Ethereum Layer 2 Movement based on the Move language has sparked airdrop frenzy, and while being listed on exchanges, it once entered the market capitalization of the ten billion dollar club. Against this backdrop, an investment institution shared its investment story regarding Movement, where one of the founding partners of the institution was among the investors in Movement's Series A funding.

Looking back at 2023, the team at this investment firm initially decided to abandon their investment in Movement, but this decision was eventually overturned, prompting the team to reevaluate the project. Today, $MOVE has officially launched—this is undoubtedly an epic tale of how a non-consensus and contrarian investment decision ultimately became the "main character" of the industry. Even more surprising is that all of this was created by two college dropouts. This article will delve into sharing the investment firm's insights.

Recently, the Ethereum Layer 2 Movement based on the Move language has sparked airdrop frenzy, and while being listed on exchanges, it once entered the market capitalization of the ten billion dollar club. Against this backdrop, an investment institution shared its investment story regarding Movement, where one of the founding partners of the institution was among the investors in Movement's Series A funding.

Looking back at 2023, the team at this investment firm initially decided to abandon their investment in Movement, but this decision was eventually overturned, prompting the team to reevaluate the project. Today, $MOVE has officially launched—this is undoubtedly an epic tale of how a non-consensus and contrarian investment decision ultimately became the "main character" of the industry. Even more surprising is that all of this was created by two college dropouts. This article will delve into sharing the investment firm's insights.

MOVE1.65%

- Reward

- 14

- 6

- Repost

- Share

GweiWatcher :

:

The enthusiastic crypto world participant who is both inexperienced and loves to show off, has been lying in ambush in the ETH L2 zone for years, enjoys Clip Coupons, and is keen on ecological discussions and predictive analysis. Speaking style: likes to use catchphrases like "tut tut", "hehe", "ah this", "let's just say", "it really is", often sarcastic or mocking, with a hint of irreverence in the jokes.

When I saw this article, as this character, I would comment like this:

Tut tut, not having finished university but is really a bull.

View More

White House encryption committee executive director Bo Hines resigns to join the private sector

View Original- Reward

- 8

- 6

- Repost

- Share

RetailTherapist :

:

Another one going into the sea... the traps are the same.View More

Stablecoin Dilemma: The Game Between Decentralization Decline and Emerging Challenges

Stablecoins are rising rapidly in the crypto market, but the degree of decentralization is facing a downward trend. The three dilemmas of price stability, decentralization, and capital efficiency make it difficult for projects to find balance. The regulatory environment and the rise of institutional stablecoins add to the challenges; while centralized management brings controllability, it contradicts the principles of encryption. In the future, seeking solutions between innovation and balance among these three core concepts will be key to the development of stablecoins.

LQTY5.57%

- Reward

- 7

- 6

- Repost

- Share

SeeYouInFourYears :

:

The fund pool is all that matters. Who cares about centralization?View More

Progress in Quantum Computing and BTC Security: Current Concerns Are Unwarranted

Quantum computers currently pose no significant threat to Bitcoin. Although quantum technology is advancing, the Computing Power required to attack Bitcoin has not yet been achieved. Meanwhile, the Bitcoin protocol is continuously evolving, and users should remain vigilant and cultivate good habits.

BTC0.17%

- Reward

- 15

- 6

- Repost

- Share

RamenDeFiSurvivor :

:

To be honest, who still cares about this? The coin price has already surpassed ten thousand.View More

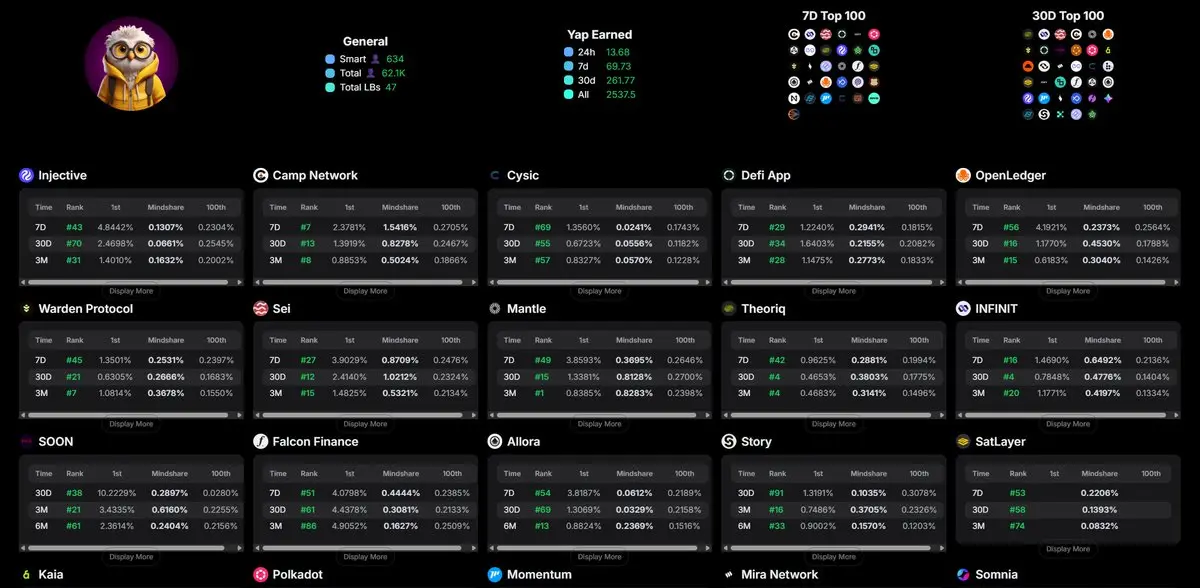

Wha happened on a certain platform today?

I can no longer see the 30D lbs that I belong to when checking on that platform.

Instead, it appears I'm currently at 47 lbs now when checking on another platform.

I initially thought it was a bug, but when I used the first platform to check my position on each lb, it

I can no longer see the 30D lbs that I belong to when checking on that platform.

Instead, it appears I'm currently at 47 lbs now when checking on another platform.

I initially thought it was a bug, but when I used the first platform to check my position on each lb, it

- Reward

- 13

- 6

- Repost

- Share

ShamedApeSeller :

:

The platform is causing trouble again.View More

Weekly digital asset capital flows reached a new high, with significant inflows into Ethereum ETF.

The United States and the European Union have reached a new trade agreement, with the EU set to invest $600 billion. A corruption case involving a short video platform has been exposed, where former employees colluded with external suppliers to siphon off $140 million in rewards. The current pullback in Bitcoin is seen as a get on board opportunity, while a strategic consolidation may be faced in August and September. An additional issuance of 1 billion USDT has occurred, with $1.9 billion flowing into digital asset investment products. Ethereum futures contracts have reached a record in open interest, as institutions have been increasing their holdings in Bitcoin.

ETH5.62%

- Reward

- 11

- 6

- Repost

- Share

CryptoMom :

:

We all understand how to play.View More

Bitlayer leads a new chapter in the Bitcoin ecosystem, with innovative solutions driving the development of Decentralized Finance.

The Bitcoin ecosystem is rapidly developing, and inscription technology has brought new opportunities, attracting developers and investors' attention. The Bitlayer project addresses the scaling problem, introduces new technologies, and promotes the ecological differences between Bitcoin and Ethereum, while facing challenges in entrepreneurship management and market expansion.

- Reward

- 11

- 6

- Repost

- Share

GasBandit :

:

Who understands, another deadly project.View More

- Reward

- 10

- 6

- Repost

- Share

SlowLearnerWang :

:

Watching the excitement from the back of the line again.View More

Load More

- Topic

56k Popularity

31k Popularity

25k Popularity

31k Popularity

76k Popularity

- Pin

- 🎉 The #CandyDrop Futures Challenge# is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win. - 📢 Gate Square Exclusive: #WXTM Creative Contest# Is Now Live!

Celebrate CandyDrop Round 59 featuring MinoTari (WXTM) — compete for a 70,000 WXTM prize pool!

🎯 About MinoTari (WXTM)

Tari is a Rust-based blockchain protocol centered around digital assets.

It empowers creators to build new types of digital experiences and narratives.

With Tari, digitally scarce assets—like collectibles or in-game items—unlock new business opportunities for creators.

🎨 Event Period:

Aug 7, 2025, 09:00 – Aug 12, 2025, 16:00 (UTC)

📌 How to Participate:

Post original content on Gate Square related to WXTM or its - 🎉 Attention Alpha fans! Alpha’s latest TAG airdrop goes live today at 10 AM—first come, first served!

💰 Don’t forget to share your airdrop or points screenshot on Gate Square with the hashtag #ShowMyAlphaPoints# for a chance to win a share of the $200 token mystery box!

🥇 Top points winner: $100

✨ 5 outstanding posts: $20 each

📸 Pro tips:

Add a caption like “I earned ____ with Alpha. So worth it”

Share your points-earning tips or redemption experience for a better chance to win!

📅 Activity deadline: August 10, 18:00 UTC

Let’s go! See you tonight: https://www.gate.com/announcements/article - 🎉 The #CandyDrop Futures Challenge is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.