連邦準備制度の利息率引き下げに加え、暗号資産市場の将来を決定する重要なデータポイントがもう1つあります

記事では、関税問題が短期的な市場の波乱を引き起こしているものの、長期的な市場トレンドはインフレと利下げの期待によって依然として主導されていることが指摘されています。元のタイトル 'Besides the Federal Reserve’s Interest Rate Cuts, Another Important Data Point Deciding the Future of Crypto Market | BK Weekly #23' を転送する

TL;DR

関税の緊張が一週間続いた後、市場はついに週末に少し余裕を見つけました。しかし、この休息がどれほど続くかは不確かであり、関税問題はイベント駆動型であり、リスク回避と一時的なセンチメントの崩壊につながり、大幅なボラティリティをもたらします。市場が関税によって引き起こされた基本的な変化とリスク回避的センチメントの解放を確認すると、金融市場全体が新たな均衡を見つけるでしょう。これが世界の株式市場、特に米国株式市場が先週利益を上げた理由であり、S&P 500ボラティリティ指数の変化に証明されています。

先週、VIX指数は最近の高値に達し、過去数年間でそれに匹敵する唯一の出来事は、去年日本銀行の利上げによる急騰と2020年のパンデミックによる金融動乱です。これが過去1週間で市場が非常に大きな変動を経験した理由であり、このような出来事は歴史上珍しいためです。

今、この巨大な変動が収まると、暗号資産市場のトレンドに影響を与える要因は、「インフレーション」と「利息率の引き下げ」というおなじみのトピックに戻ります。なぜなら、利息率の引き下げしか「金山を氾濫させる」ことができず、BTCをリードするリスク資産の成長期待をもたらすからです。

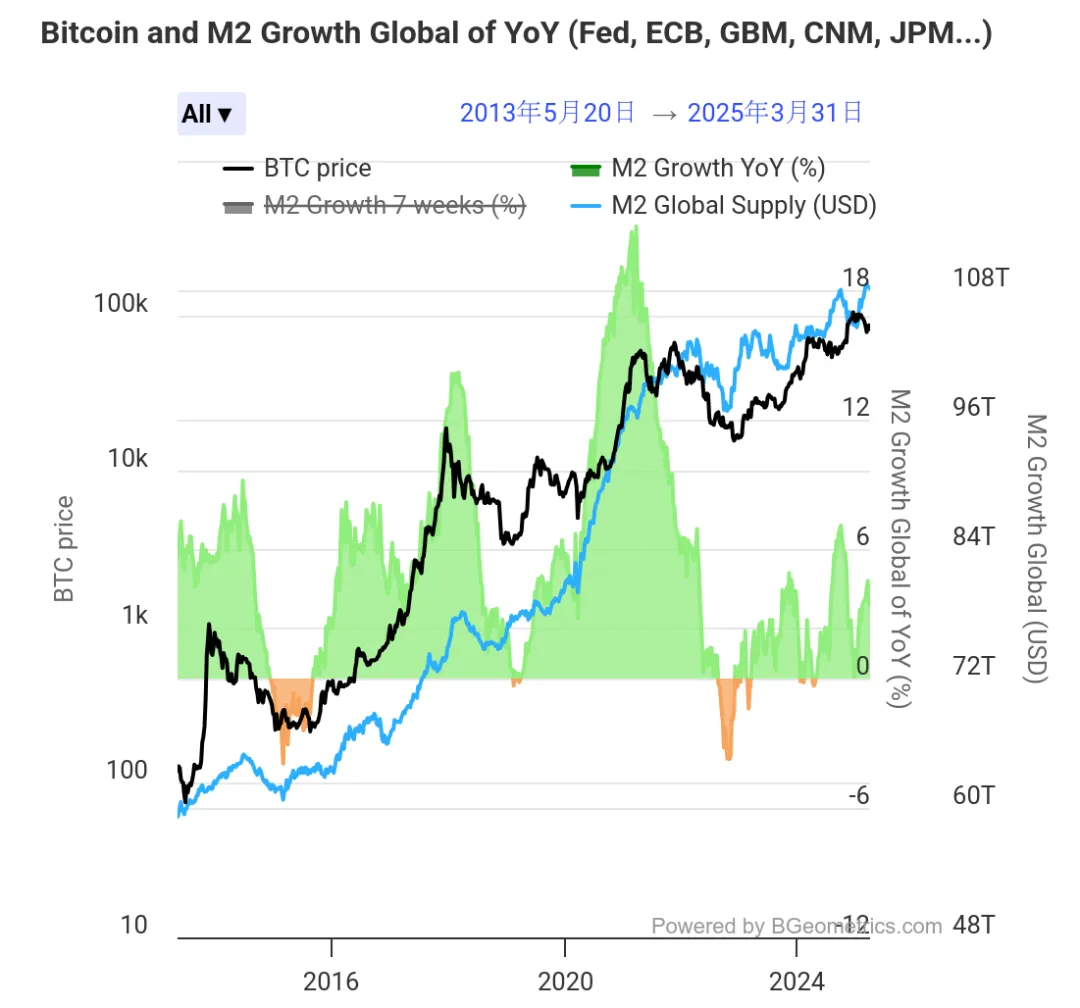

過去10年間のBTCのパフォーマンスと世界の広義マネーサプライ(M2)を比較することで、この相関関係を分析することができます。下のチャートは、過去10年間のBTCの急増が世界的なM2の急増を基盤として構築されており、この相関関係は他の金融データよりも遥かに優れています。

これは、アメリカがインフレや利下げに関連するデータを公表する直前にいつも、BTCは変動を経験する傾向がある理由です。なぜなら、それは新しい資金が暗号資産空間に流入するかどうかに最終的に影響するからです。

しかし、現時点では、暗号資産市場は主に米連邦準備制度の利息率引き下げの方向に焦点を当てているようで、中国の通貨の流動性を反映する重要なデータである中国人民銀行(PBOC)の資産規模を見過ごしているようです。

西海岸の金融市場に注目が集まっている間、私たち自身の金融流動性を無視しています。実際、私たちもBTCの価格変動と密接に関連しており、結局、私たちは主要なグローバルパワーです。

過去3サイクルのBTCの価格変動とPBOC資産規模の成長との相関を示すチャートは以下の通りです。 これは、この相関がすべての主要なBTC急騰時に明らかであり、4年ごとのサイクルに対応していることがわかります。

2020年から2021年の暗号資産ブルマーケット、2022年のベアマーケット、2022年末から2023年初めのサイクル安値からの回復、2023年第4四半期の急騰(BTC ETFの承認前)、そして2024年第2四半期から第3四半期の訂正に、中国人民銀行(PBOC)の流動性が影響を与えた。

同様に、2024年の米国大統領選挙の数か月前、PBOCの流動性は再びプラスに転じ、『選挙ブル相場』に至った。

しかしながら、下のグラフで見られるように、2024年9月以降、中国人民銀行(PBOC)の資産規模は減少し始め、年末には底をつき、その後反発して過去1年間に見られなかった高値に達しました。データの相関の観点からは、PBOCの流動性の変化は通常、BTCや暗号資産市場の大幅な変動の前触れとなります。

興味深いことに、2017年のBTCブルマーケット中、連邦準備制度は市場に"浸水"する主体ではなかった。その代わりに、その年に3回利上げし、量的緊縮に取り組んだ。しかし、BTCを先導とするリスク資産は、中国人民銀行の資産規模がその年に新記録を達成したために、2017年に非常に楽観的なパフォーマンスを続けた。

S&P 500の成長に関しても、中国人民銀行(PBOC)の流動性とある程度の相関関係があります。歴史的に見て、PBOCの総資産規模とS&P 500の年間パフォーマンスとの相関係数はおよそ0.32(2015年から2024年のデータに基づく)です。

もちろん、ある意味、これはまた、中国人民銀行の四半期金融政策報告と連邦準備制度の利子政策会合の時間枠が重なるため、短期間で相関関係を強調するという理由もあります。

要約すると、米国の金融緩和策を注意深く監視するだけでなく、国内の金融データの変化にも注意を払う必要があることが分かります。 1週間前に、「準備率引き下げや金利引き下げなどの手段は適切な調整余地があり、いつでも実施できる」というニュースが発表されました。 私たちの任務は、これらの変化を追跡することです。

2025年1月時点で、中国の総預金額は42.3兆米ドルであり、一方、アメリカの預金残高は約17.93兆米ドルです。預金規模において、我々にはより多くの金融ポテンシャルがあることは否定できません。もし流動性が改善すれば、いくつかの変化をもたらすかもしれません。

もちろん、もう一つ探る価値のあるポイントは、流動性が増加すれば、それが暗号資産市場に流れ込むかどうかです。 まだいくつかの制限がありますが、香港はすでに答えを提供しています。 政策の柔軟性と利便性の観点から、数年前と比較して事態は変わっています。

最後に、今週のレビューを終わらせるために、私は雷军の言葉を借りましょう: 「風が吹けば、豚でも飛べる」。流れに逆らうよりも波に乗ったほうが良い。待つこと以外に、風が吹くときに登る勇気を持ち、逆風に逆らって飛び立つことが必要です。

免責事項:

この記事は[から転載されましたブロックチェーンナイト原題「Federal Reserveの利息率引き下げに加え、暗号資産市場の未来を決定するもう1つの重要なデータポイント|BK Weekly #23」を転載します。著作権は原著者に帰属します[ブロックチェーンナイト]. If you have any objections to the reprint, please contact Gate Learnチーム、チームは関連手続きに従ってできるだけ早く対応します。

免責事項:この記事で表現されている見解や意見は、著者個人の見解を表しており、投資アドバイスを構成するものではありません。

他の言語版はGate Learnチームによって翻訳されます。翻訳された記事は、出典を明記せずにコピー、配布、あるいは盗用することはできません。Gate.io.

関連記事

定量的戦略取引について知っておくべきことすべて

ブロックチェーンについて知っておくべきことすべて

ステーブルコインとは何ですか?

流動性ファーミングとは何ですか?