Keep smashing it for me.

View OriginalMeituanDeliveryManAh

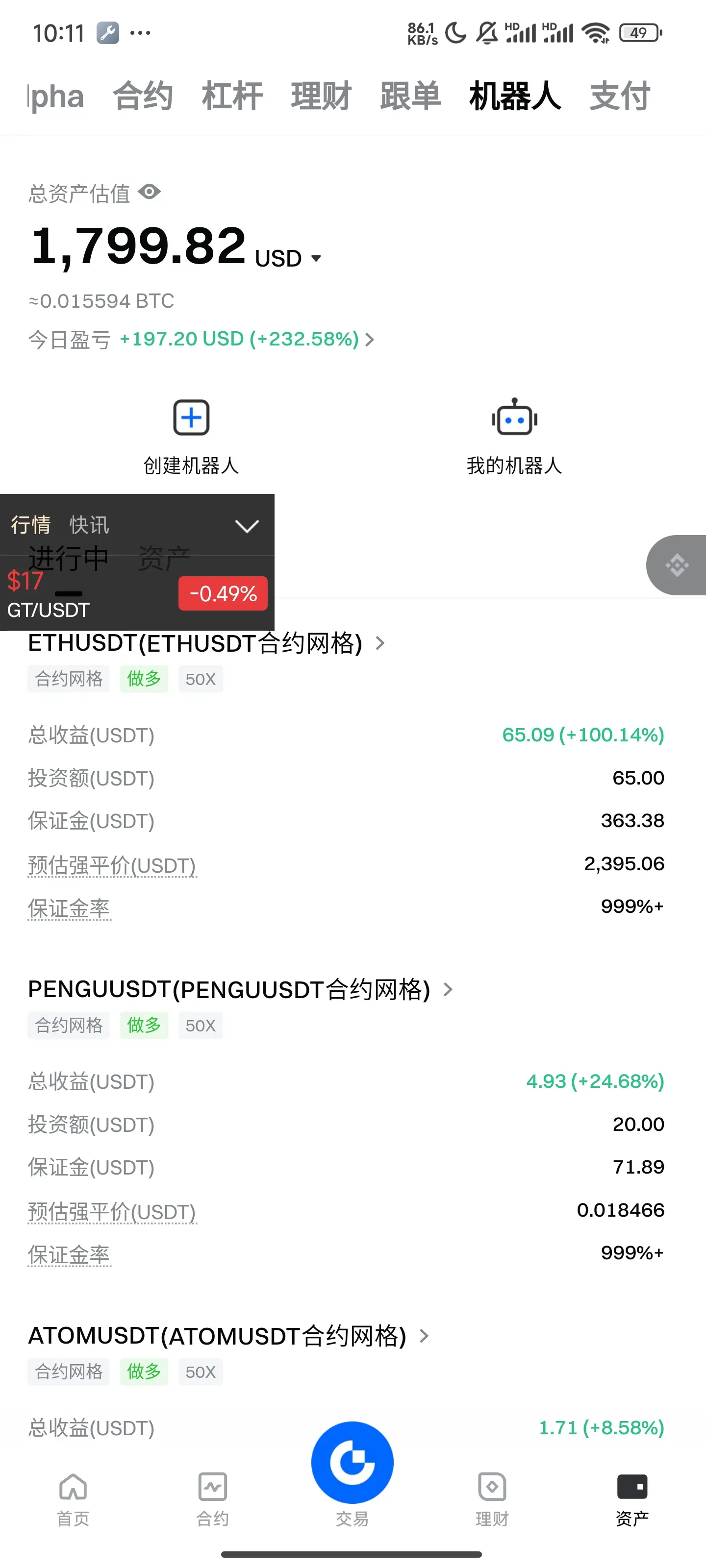

Only know how to do grid trading, contract purely depends on feel.

MeituanDeliveryManAh

#Gate ETH 挖矿年化收益 5%# I recommend a small coin that can earn you 50u daily. Bots control the market trend. I don't suggest buying too much; 100u is enough. Basically, it pumps once every one or two days, with each pump around 70 to 80 points. I've earned 500u #晒出我的Alpha积分# .

View Original

- Reward

- 1

- Comment

- Repost

- Share

Everyone can take a look at the BTC trend that I drew the day before yesterday.

BTC-0.2%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Garlic Bird Garlic Bird Unbeatable Stable Profit

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

I lost so much, damn it. I've been shorting and pumping continuously.

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 1

- Repost

- Share

LongXiaohai :

:

dogSalary has been paid, just get it done. The Federal Reserve meeting is at 2:30 AM tonight, probably hawkish remarks. High inflation, or interest rate hikes, high interest rates, and the yield on dollar assets remains high.

Institutions and retail investors may sell off and turn to investing in dollars. This could lead to a drop in Bitcoin, and altcoins are likely to follow suit, resulting in a sluggish market. Tonight at two o'clock, we will welcome the silky waterfall.

Just short it directly at this high position.

View OriginalInstitutions and retail investors may sell off and turn to investing in dollars. This could lead to a drop in Bitcoin, and altcoins are likely to follow suit, resulting in a sluggish market. Tonight at two o'clock, we will welcome the silky waterfall.

Just short it directly at this high position.

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 2

- Repost

- Share

FaithIsFulfilled :

:

How much of the salary I just received is left? I almost got liquidated on BTC last night, I lost 50% and closed it.View More

Ten years of Cryptocurrency Trading, from losing everything to earning back 10 million: the top ten iron rules!

-

Tianqing has been in the cryptocurrency trading circle for more than ten years. Starting with a principal of 5000 yuan, he made over 10 million during the bull market, but lost it all within three years and even incurred a loss of 7 million. Finally, he turned his fortunes around with a borrowed 200,000 yuan, earning back 10 million. Along the way, I have summarized the top ten rules of cryptocurrency trading, which I would like to share with you today, hoping to help you avoid det

View Original-

Tianqing has been in the cryptocurrency trading circle for more than ten years. Starting with a principal of 5000 yuan, he made over 10 million during the bull market, but lost it all within three years and even incurred a loss of 7 million. Finally, he turned his fortunes around with a borrowed 200,000 yuan, earning back 10 million. Along the way, I have summarized the top ten rules of cryptocurrency trading, which I would like to share with you today, hoping to help you avoid det

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

Short 2600 Margin Replenishment 2630 Short eth

ETH5.59%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Last night I sensed something was off, so I conducted a thorough analysis using Bollinger Bands, MACD, moving averages, DeMark sequences, and the VPVR indicator. I gained an in-depth understanding and interpretation of the policies of The Federal Reserve, Wall Street, and various Central Banks. After rigorous calculations using trading methods such as Chan theory, Elliott waves, the Wister spiral, and Fibonacci, I....

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 4

- 2

- Repost

- Share

MeituanDeliveryManAh :

:

I am finally trapped.View More

icnt has reached the market turning point, buying a bit of 10 or 20 oil can multiply three to four times.

ICNT7%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 4

- Repost

- Share

RidingTheWindAndBrea :

:

Refer to MATView More

- Reward

- like

- 1

- Repost

- Share

SmallSweetCalf :

:

This...The UNI market has fallen again. In fact, $UNI has returned to the oscillation zone, and it's so difficult to stand above 7.0. This is already the eighth week of oscillation after the weekly closing above 6.0. Prolonged stagnation must lead to significant changes, which means, as mentioned a few days ago, this month's monthly line may receive above 10.

Before the market breaks through, those who can continue to build positions after the fall should do so. Starting from 6.8, place orders (. Last time, positions started to be built around 7.0. Now, starting to build positions in batches won't be

Before the market breaks through, those who can continue to build positions after the fall should do so. Starting from 6.8, place orders (. Last time, positions started to be built around 7.0. Now, starting to build positions in batches won't be

UNI1.19%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 4

- 3

- Repost

- Share

Jasimawf :

:

nice 👍 workView More

Why am I bringing up this previous trade? It's to summarize the trading strategy from June 24th. This time I'm planning to do a 4-hour short order. The previous decline was a 5-wave pattern, and after it ended, it formed a V shape. Starting from 110623, it rebounded to 105800 Fibonacci (0.682), so I shorted 0.5 times. Let's see if we can catch a pullback from a secondary fluctuation. In reality, the result did not go as expected, so I had to stop loss. Since the starting point was short-term, holding the position for too long lost its advantage, so it didn't decline as I imagined, which actual

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- 2

- Repost

- Share

Ybaser :

:

Hold on tight, we're about to To da moon 🛫View More

Let me talk about a 4-hour trade I made on April 10th. Previously, there was a wave of 3 falls, and it paused around 74000 to rebound, forming a W pattern. Then it broke through the W, reaching the Fibonacci 0.682 of the decline starting from 88500, which is also the area of previous sideways movement, creating resistance. Therefore, I opened a short order of 0.5 times at the red circle. Subsequently, it fell to around 79800 (0.382), and further down to 77700 is the stop loss medium term. Those who are attentive might notice that this position is exactly where the annual line (ma360) support i

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- 2

- Repost

- Share

Ybaser :

:

Hold on tight, we're about to To da moon 🛫View More

Trade with a small amount to gain a large return, using only the money you can afford to lose. Do not let trading affect your quality of life. Being in debt is even worse, as it means you've already lost the right mindset.

View Original[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share